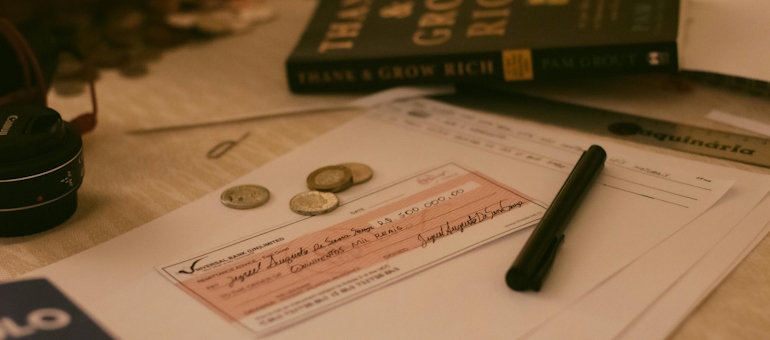

Protect Yourself From Old Fashioned Check Fraud

With technology making it more difficult for fraudsters to carry out digital financial scams, we have seen a rise in old fashioned check washing.

Scenario – you receive a bill from your lawn care service. You write check number 2324 make the check out to Lush Lawn Service for $200 and drop it in a mailbox. A couple of days later, you log into digital banking and notice that check number 2324 has cleared your account, but it is made out to an individual and the amount shows $2,000. The reality is you’ve become a victim of check washing.

Check washing begins when criminals steal checks from either business/residential mailboxes or go “fishing” by using coated string to lift envelopes from public mailboxes and sorting to find ones that may contain checks. Once they have checks in hand, chemical solvents are used to “wash” the payee and payment amount information from them. The checks are then filled in with the criminal’s name and amounts of their choosing.

Taking things a step further, some fraudsters will use the information on the check and/or bill to steal the identity of the account holder. Often, they will take out loans in the name of the victim, print counterfeit checks, or even create fake passports or identification cards.

Bank Tools Designed to Reduce Risk

You can reduce the risk of check washing and other types of check fraud by implementing tools already available to you from your bank, including:

- Digital payments. It’s impossible to wash a check that hasn’t been written. Paying electronically, whether it be through bill pay or an online portal for the biller, can help head off an opportunity for check fraud.

- Automated payments. ACH and automatic bill pay are great options for recurring payments, taking checks out of the equation.

- Mobile banking. By regularly monitoring account activity through mobile banking, you greatly reduce your chances of falling victim to check fraud. You’ll be able to see for yourself that checks written are cashed for the right amount by the correct person or business.

- Positive pay. Available to business customers, when checks are sent out using positive pay, our banking team receives details including the account number, amount, and check number giving you the opportunity to confirm that it’s being deposited or cashed correctly, or flag a transaction that you suspect may be fraud.

- Security features and check verification. Features like microprinting and watermarks can help make checks harder to counterfeit.

Be Your Own Best Defense

There is a lot you can do on your own to avoid check washing. Save yourself a headache down the road by:

- Deposit checks right away. If you write a check to someone and you notice is hasn’t cleared your account within a reasonable amount of time, reach out to them to ensure it gets taken care of or you can take action to protect your funds.

- Use BLACK ink. Permanent black gel pens are recommended for check writing. Black gel ink penetrates the paper fibers, making it much more difficult to wash the check.

- Avoid making checks out to CASH or leaving them blank. Make checks payable to the business name or the name of the individual. Leaving payee or payment amount lines blank invites fraud.

- Keep checks secure. When an order of checks arrive, choose a secure place to store them until they are needed.

- Don’t leave outgoing mail unattended. Leaving outgoing mail in a business or residential mailbox exposes you to risk. While public mailboxes are better, your best bet is to hand mail directly to a mail carrier or take it inside the Post Office yourself.

- Schedule mail pickup. If you own a business and have a large amount of outgoing mail, having a postal worker pick it up at a designated time can provide a secure solution. Make a point to get to know your mail carrier. If you know what they look like and roughly when to expect them you can avoid falling victim to someone posing as a postal worker.

- Check your mailbox daily. Mail should never sit in an unsecured mailbox overnight. If this is a challenge, consider renting a post office box. This will ensure mail is secure. If you leave town, contact the postal service to hold the mail.

- Use informed delivery. The postal service offers informed delivery, which ensures that the mail received is actually delivered to the intended address.

- Check your bank statement promptly. If you see an unfamiliar charge on your bank statement, contact your bank right away.

- 30-day rule. Dispose of canceled checks, checks deposited through the mobile app, credit card statements, and bills securely (shredding, burning, etc.) after 30 days.